Insured millennials today are facing several health challenges, notably cancer and cardiovascular conditions. This was revealed in Liberty's Claim Statistics for 2017.

Most people filed insurance claims for cancer – both young and old. But Henk Meintjes, Head of Risk Product Development at Liberty, said that more young people than ever before are being diagnosed with illnesses like cancer and cardiovascular disease.

Starting young

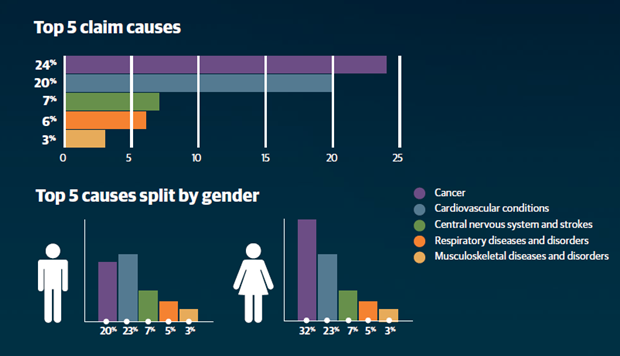

"Cancer is the top claim cause at 24.3% [of our number of claims], and cardiovascular conditions a close second at 20%. And while cancer affects people of all ages, it was 16% for young achievers – the millennials – and 21% for young parents.

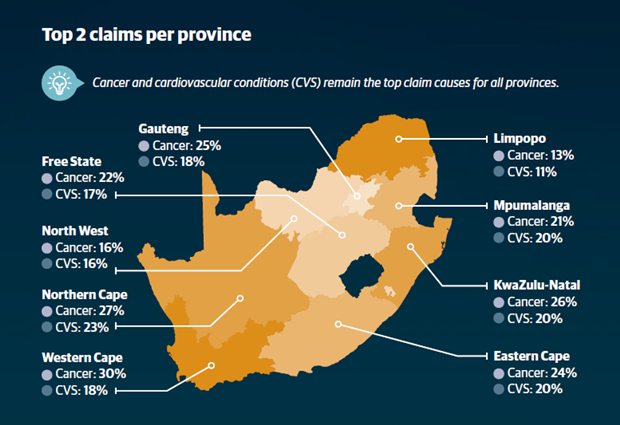

"In the Western Cape, cancer claims were at 30%, and in Gauteng they were at 25%. In KwaZulu-Natal, cardiovascular conditions were more prominent at 26%, and cancer at 20%,” said Meintjes.

The other top reasons for claiming were central nervous system conditions and strokes at 7%, respiratory diseases and disorders at 6% and musculoskeletal diseases and disorders at 3%.

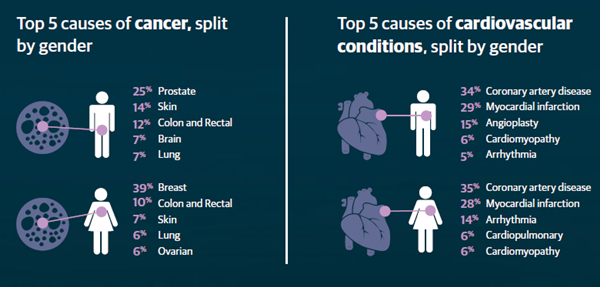

The top cancer types claimed for were breast cancer (in women), prostate cancer and colon cancer.

Early diagnoses

Meintjes added that numbers of cancer diagnoses have increased significantly. He said that in reality we all have cancer cells in our bodies, but that these diseases can be detected at an increasingly early stage.

"We are diagnosing cancer far earlier than in the past, which is great because you can get treated earlier, but from an insurance perspective, it means that we are seeing many 'earlier' claims.

"Some cancers, not necessarily picked up in the past, are now being diagnosed, so we see more claims taking place here as well."

Adjustments to cut costs

"As an insurer, we realise that premiums will go up if we don't change the way we pay out benefits. If cancer is diagnosed early enough, treatment is actually quite simple, and you don't need the same lifestyle adjustments.

"For example, if someone needs to have a mastectomy or something similar, we need to look at adjustments to cut costs, so that premiums don't run away to the point where clients can't afford to be covered anymore," said Meintjes.

In his presentation, Meintjes mentioned there were some claims which were not paid out. This was due to reasons such as non-disclosure of certain conditions, but mostly due to claims not matching the requirements specified in the policies.

Image credits: iStock, Liberty

Publications

Publications

Partners

Partners