As a medical scheme member, you probably expect your full treatment costs to be covered should you or your dependents be hospitalised. Unfortunately, this is seldom the case.

Medical scheme payouts are limited to what schemes call their Medical Scheme Tariff amount (MST), while certain medical practitioners charge up to four times the MST amount.

This mismatch between the amount charged by medical practitioners and that funded by medical schemes creates a shortfall or gap for which the member is liable.

The total Rand amount of these gaps can be significant, often causing severe financial stress and/or consequences for the affected medical scheme member.

Read: 10 tips on choosing a medical scheme

Click here to the video that explains a little bit more about what the gap cover is.

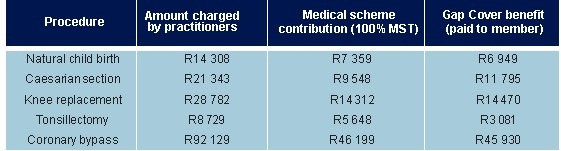

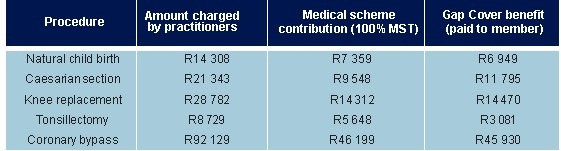

The table below illustrates the shortfalls that occur across 5 of the most common treatments. The examples show the real combined medical practitioner charges, the amount paid by the scheme, as well as the shortfall or amount covered for members with Liberty Health Medical Gap Cover.

Liberty Health’s Medical Gap Cover is probably the best known Gap Policy available to all medical scheme members, not just members of Liberty Medical Scheme. As an insurance policy, it doesn’t replace the need for medical scheme cover but rather complements it.

Benefits offered by Liberty Health’s Medical Gap Cover:

• Cover of up to 500% of MST

• R2 500 000 cover per family, per year

• R20 000 automatic co-payment cover

• Cover is not restricted to in-hospital treatment but also includes cover for approximately 50 out-of-hospital treatments

• Cover for the immediate family – those family members listed as medical scheme dependents

• Cover for parents and siblings of the policyholder – those who are listed as medical scheme dependents

• No maximum age limit restrictions

• No blanket pre-existing condition exclusions

• Cover for Prescribed Minimum Benefit (PMB) conditions

To find out more, contact your Liberty Agent or Liberty-appointed Independent Financial Advisor. Alternatively, contact Zestlife, the administrators of the Liberty Health Medical Gap Cover Policy on 0860 009 378 or by email on gap@zestlife.co.za.

Medical scheme payouts are limited to what schemes call their Medical Scheme Tariff amount (MST), while certain medical practitioners charge up to four times the MST amount.

This mismatch between the amount charged by medical practitioners and that funded by medical schemes creates a shortfall or gap for which the member is liable.

The total Rand amount of these gaps can be significant, often causing severe financial stress and/or consequences for the affected medical scheme member.

Read: 10 tips on choosing a medical scheme

Click here to the video that explains a little bit more about what the gap cover is.

The table below illustrates the shortfalls that occur across 5 of the most common treatments. The examples show the real combined medical practitioner charges, the amount paid by the scheme, as well as the shortfall or amount covered for members with Liberty Health Medical Gap Cover.

Liberty Health’s Medical Gap Cover is probably the best known Gap Policy available to all medical scheme members, not just members of Liberty Medical Scheme. As an insurance policy, it doesn’t replace the need for medical scheme cover but rather complements it.

Benefits offered by Liberty Health’s Medical Gap Cover:

• Cover of up to 500% of MST

• R2 500 000 cover per family, per year

• R20 000 automatic co-payment cover

• Cover is not restricted to in-hospital treatment but also includes cover for approximately 50 out-of-hospital treatments

• Cover for the immediate family – those family members listed as medical scheme dependents

• Cover for parents and siblings of the policyholder – those who are listed as medical scheme dependents

• No maximum age limit restrictions

• No blanket pre-existing condition exclusions

• Cover for Prescribed Minimum Benefit (PMB) conditions

To find out more, contact your Liberty Agent or Liberty-appointed Independent Financial Advisor. Alternatively, contact Zestlife, the administrators of the Liberty Health Medical Gap Cover Policy on 0860 009 378 or by email on gap@zestlife.co.za.

Publications

Publications

Partners

Partners